Navigating the UK’s Financial Landscape: A Guide to Expat Wealth Management

So, you’re an expat in the UK, building your life and career, but what about your finances? It’s easy to get caught up in daily life, but managing your wealth as an expat comes with its own unique set of challenges and opportunities. Ignoring them could mean missing out on significant financial growth or, worse, running into unexpected tax issues. This guide will help you understand the essentials of expat wealth management in the UK, ensuring your money works as hard as you do.

Why Expat Wealth Management is Different

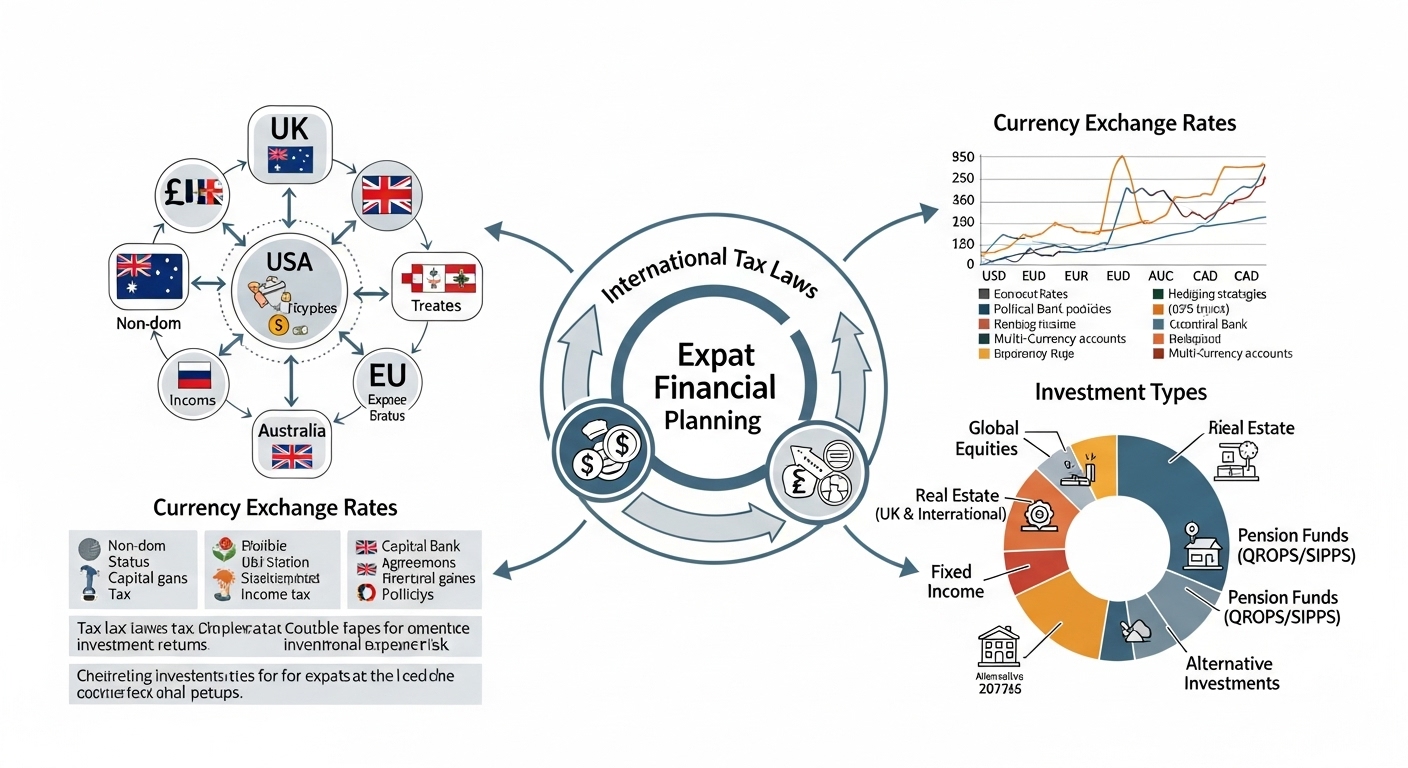

Being an expat isn’t just about living in a new country; it’s about navigating a completely different financial ecosystem. For expats in the UK, this often means dealing with:

- Complex Tax Rules: Understanding UK tax residency, domicile, and how your overseas income and assets are treated can be a real headache.

- Currency Fluctuations: Your wealth might be spread across different currencies, impacting its value.

- International Regulations: Rules around pensions, investments, and inheritances often differ between countries, requiring specialist knowledge.

- Global Investment Opportunities: You might have access to a broader range of investment avenues, but knowing which ones are suitable and compliant is key.

Without a tailored approach, it’s easy to make costly mistakes or fail to capitalise on potential benefits.

Key Pillars of Expat Wealth Management in the UK

Effective wealth management for expats typically revolves around several core areas:

1. Tax Planning: This is arguably the most critical aspect. A good expat wealth manager will help you understand your UK tax obligations, optimise your tax efficiency, and navigate complexities like the remittance basis, capital gains tax, and inheritance tax, especially concerning international assets.

2. Investment Strategies: Your investment portfolio needs to reflect your global situation. This includes considering currency risks, diversified international investments, and ensuring your chosen vehicles are tax-efficient in the UK.

3. Pension Planning: Whether you have existing pensions from your home country (like QROPS or SIPPs) or are contributing to a UK pension, managing these effectively is vital for your retirement. Understanding cross-border pension transfers and the associated tax implications is crucial.

4. Estate Planning: What happens to your assets if something goes wrong? For expats, this involves considering the inheritance laws of multiple countries and setting up wills and trusts that are legally binding and tax-efficient across borders.

5. Property Management: If you own property in the UK or abroad, a wealth manager can help with mortgage advice, property investment strategies, and understanding the tax implications of rental income or sales.

Choosing the Right Expat Wealth Management Business

With so many financial advisors out there, how do you pick the right one for your unique expat needs? Here’s what to look for:

- Specialist Expat Knowledge: They must have demonstrable expertise in international tax, cross-border investments, and regulations affecting expats.

- Regulatory Compliance: Ensure they are authorised and regulated by the Financial Conduct Authority (FCA) in the UK.

- Transparent Fee Structure: Understand exactly how they charge for their services – whether it’s a percentage of assets under management, fixed fees, or hourly rates.

- Client-Centric Approach: They should take the time to understand your personal goals, risk tolerance, and long-term aspirations.

- Proven Track Record: Look for testimonials, case studies, or reviews from other expat clients.

Don’t Go It Alone!

Managing your wealth as an expat in the UK can feel like navigating a maze. From complex tax codes to diverse investment opportunities, having a specialist expat wealth management business on your side can make all the difference. They offer not just advice, but peace of mind, allowing you to focus on enjoying your life in the UK while your financial future is expertly handled. Don’t leave your financial well-being to chance – seek professional guidance tailored to your unique situation. Your future self will thank you for it!